Comprehensive VAT Solutions for UAE Businesses

We help you with:

- VAT Registration (TRN)

- Monthly / Quarterly VAT Filing

- VAT Return Preparation

- VAT Reconsideration

- VAT Deregistration

- VAT Accounting Setup

Why Choose Our VAT Consultancy in UAE

100% FTA Compliance

We ensure your VAT processes match the latest UAE tax regulations.

Zero Penalty Assurance

Accurate, on-time filing prevents unnecessary fines.

Expert Tax Professionals

Experienced VAT consultants with in-depth UAE tax knowledge.

Fast Processing

Quick turnaround for registration, filing & VAT support.

Business Insights

We guide you on tax-saving strategies & compliance readiness.

Complete Documentation Support

We handle all FTA communication & paperwork.

Types of VAT Services We Offer

VAT Registration (TRN) in UAE

We assist businesses in completing the VAT registration process with accurate documentation and obtaining the Tax Registration Number (TRN) quickly.

Monthly & Quarterly VAT Filing

We prepare, review, and file your VAT returns through the FTA portal ensuring accuracy and timely submission.

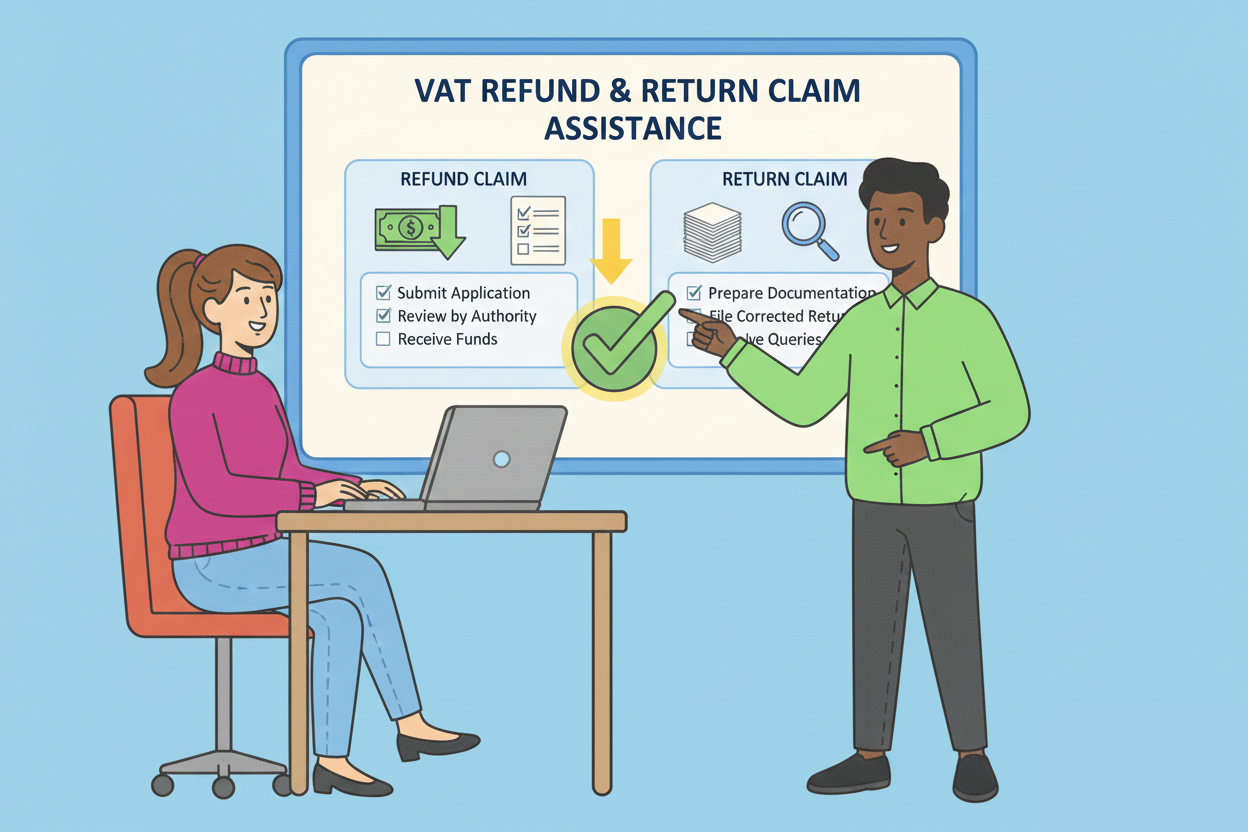

VAT Refund & Return Claim Assistance

Identify eligible input VAT, prepare refund files, and submit refund claims for faster processing by the FTA.

VAT Deregistration Services

Complete support for deregistering your VAT account when your business becomes exempt or turnover falls below the threshold.

Simple 4-Step VAT Service Process

Consultation & Requirement Check

We understand your business needs and compliance requirements

Data Collection & Financial Review

Gather necessary documents and review financial records

VAT Calculation & Filing

Accurate calculation and preparation of VAT returns

FTA Submission & Confirmation

Submit to FTA portal and provide confirmation

Ready for Stress-Free VAT Compliance in UAE?

Let our experts handle your VAT while you focus on business growth.